Is It Tax Deductible or Not?

As we move into tax season, one of the major topics the Trucker CFO team gets asked about is trucking tax deductions and whether different things are deductible or not. In our experience, we have found that the best way to start the conversation about being deductible or not begins with these two questions: Is the expense ordinary? Is the expense necessary for your business? The answers provide strong guideposts when it comes to determining whether an expense is deductible within your business or not.

As you begin to review your expenses for the year, ask yourself if it is ordinary in the course of a trucking operation and if it is necessary for the course of a trucking operation. Let’s start with the easiest expense example; is fuel ordinary and necessary for a trucking operation? The answer is an obvious yes.

At the other end of the spectrum, can you classify your pet Chihuahua as a guard dog, and can you claim the dog’s food as an expense? When we apply the criteria of ordinary and necessary, the Trucker CFO Team says no. That expense does not meet the standard of being ordinary and necessary.

Over the years, what can meet the criteria of being ordinary and necessary for a trucking operation has evolved. A laptop computer, especially for smaller trucking operations, can be a vital tool for your business. Cell phones with high-volume data plans are another necessity for your trucking business. However, if we’re talking about cell phones, those expenses must be limited to your business operation. If you have a family cell phone plan, it can become a gray area, especially if you may have family members who work within your business while other family members on the plan are not involved with the business.

Over the years, what can meet the criteria of being ordinary and necessary for a trucking operation has evolved. A laptop computer, especially for smaller trucking operations, can be a vital tool for your business. Cell phones with high-volume data plans are another necessity for your trucking business. However, if we’re talking about cell phones, those expenses must be limited to your business operation. If you have a family cell phone plan, it can become a gray area, especially if you may have family members who work within your business while other family members on the plan are not involved with the business.

Trucking is one of those most unique industries when qualifying expenses as ordinary and necessary. Let’s consider the cost of a shower. While we want all our Trucker CFO team members to shower, this is not an ordinary expense in the course of an accounting business. The facts are simple: We are not away from home, and we all have showers at our homes. Showering is something that our Trucker CFO Team can do without becoming an expense for the business.

On the other hand, if you are out on the road and living out of your truck, you still need to shower. While there are fuel vendors with points programs and rewards that include free showers, you may find yourself in a position where you have to pay for a shower. Additionally, if you are out on the road for weeks with your sleeper cab, you may need to take a break from your truck and stay in a motel during your 34-hour restart period. Getting out of the truck for the restart and resting up in a motel is one of those expenses that could qualify as ordinary and necessary.

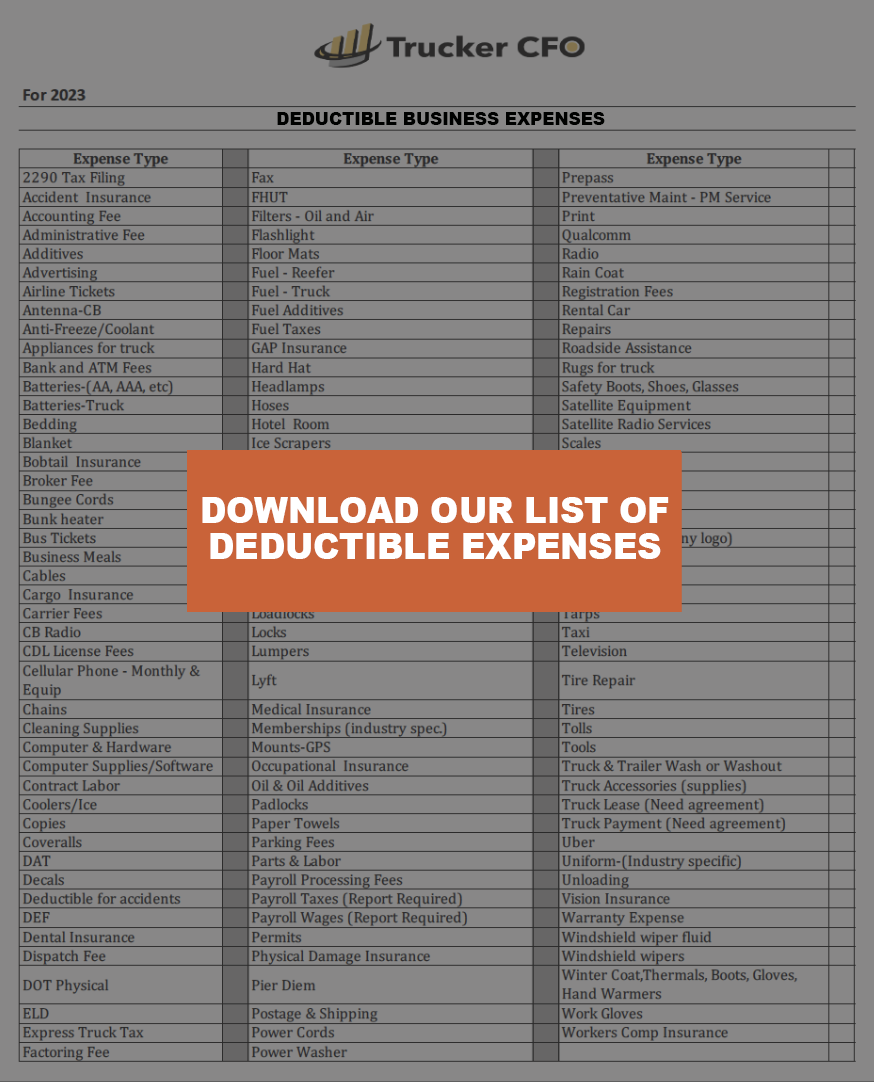

The questions we see about being ordinary and necessary don’t always provide clear-cut answers. In those situations, we will work with our clients on digging into the exact circumstances. At the end of the day, you have to consider what the IRS will be willing to accept. We have assembled a chart with a breakout of 135 deductible business expenses that we have included as part of this blog post. Additionally, we invite you to listen to our podcast where we discuss the topic of trucking tax deductions as well as other frequently-asked questions that come up during tax season.

Tax Refunds

Discussion around tax refunds has become an annual part of tax season. While getting a check in the mail or receiving an electronic deposit to your bank account is always welcome, the reality of a tax refund is that the Treasury Department is sending you back money that was essentially an interest-free loan that you provided to the government during the year.

As we mentioned earlier, trucking is unlike other industries in the United States. There are all types of drivers and classifications. You can be a company driver receiving a W-2, an owner-operator, or an independent contractor who is a business owner or self-employed. Everyone’s tax situation is different. If you hang around truck stops, terminals, or shipper locations during tax season, you might hear about a driver who got a large refund or someone who had an accountant who was less-than-strict about the standards they used regarding trucking tax deductions.

When we have people coming to us and relaying that their trucking friend was encouraged by their accountant to deduct expenses that we believe would not meet the ordinary and necessary criteria, we take the time to look at their tax situation and explain why we won’t take them down the same road on deductions.

The Trucker CFO Team Can Help You

The Trucker CFO team works hard to keep your best interest at heart, and we want to ensure you don't get into trouble. We want you to take advantage of every single deduction available for your unique situation. At the same time, we also want to ensure you stay out of the crosshairs of the IRS. We don't want the IRS coming to you, disallowing deductions and causing you more expenses than you would have had otherwise.

We enjoy working with our clients throughout the year, and that’s especially true during tax season. We value our conversations with the men and women behind the wheel in this industry. We’re happy to discuss any issue, and we believe every question deserves an answer. No point is too small or trivial. There are always new questions and situations that come up. And, when it comes to the deductions, if we believe it is not a deductible expense, we’re not going to dance around the issue; you’ll get a straightforward answer.

The answers we provide to our clients result from many years of experience working with truck drivers. The Trucker CFO team’s answers are also rooted in our many years of experience working with the IRS on audits and responding to the IRS's questions regarding truck driver tax returns and small trucking business operations.

We always keep what’s best for our clients in mind with everything that we do. We address the reality of each individual’s tax situation. As we approach the upcoming tax season, think carefully about who answers your tax questions about whether something is deductible. The choice you make for your tax preparation team may help you avoid trouble. We invite you to reach out to the Trucker CFO Team during this tax season. Contact us, and let’s start a conversation focused on helping you keep more of the money you earn in your pocket.